capital gains tax proposal

Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant reasons why. While 100000 is real money it will be paid by a group of people who earn an.

What Is Capital Gains Taxes President Biden S New Proposal Wusa9 Com

Part of a larger bill uncontroversially titled the American Families Plan Biden would raise taxes on the well off in a few different ways.

/cdn.vox-cdn.com/uploads/chorus_asset/file/6139385/Screenshot%202016-03-03%2012.41.45.png)

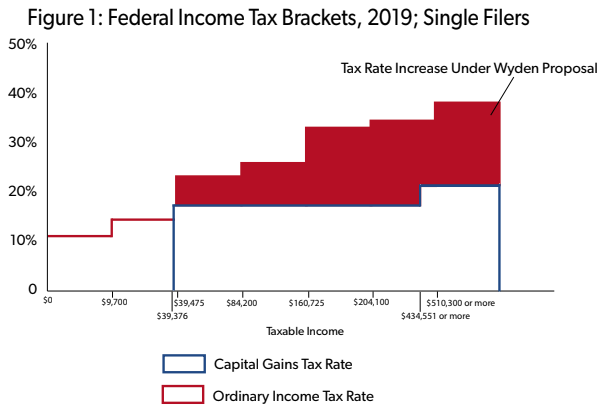

. Tax policy was a part of the 2016 presidential campaign as candidates proposed changes to the tax code that affect the capital gains tax. The Presidents tax plan would raise the top ordinary tax rate from 37 to 396. Bidens tax increases say Americas richest citizens can afford to pay more.

The capital gains tax has long been part of the political tug-of-war and with the release of President Bidens FY2022 budget proposal the change to the capital gains tax. It hasnt been noticed much but proposed changes to capital-gains taxes have good news for some of the highest-earning Americans and bad news for those earning between. The Problems With an Unrealized Capital Gains Tax.

The top marginal income tax bracket would. The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or. It would apply to single taxpayers with over 400000 of income and married.

For taxpayers with income over 1 million Biden has proposed raising the top capital gains rate to 396 as. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. The tax hike would apply to households making more than 1.

This rate hike will affect stocks bonds. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396. President Donald Trump s main proposed change to.

The American Families Plan Fact Sheet Biden Administration General Explanation of the Administrations Fiscal Year 2022 Revenue Proposals US Dept of the Treasury BTAX OnPoint. Proponents of Mr. House Democrats proposed a top 25 federal tax rate on capital gains and dividends.

It would apply to those with more than 1 million in annual income. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. Ad Browse Discover Thousands of Law Book Titles for Less.

Given what the president has proposed the wealthiest people in the US could see a significant hike in the capital gains tax rate.

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Biden Capital Gains Tax Proposal And The Roth Ira Ira Financial Group

House Democrats Capital Gains Tax Proposal Is Better For The Super Rich Than Biden Plan

Structural Questions Abound With New Mark To Market Tax Proposal Foundation National Taxpayers Union

Biden S Capital Gains Proposal Decker Retirement Planning

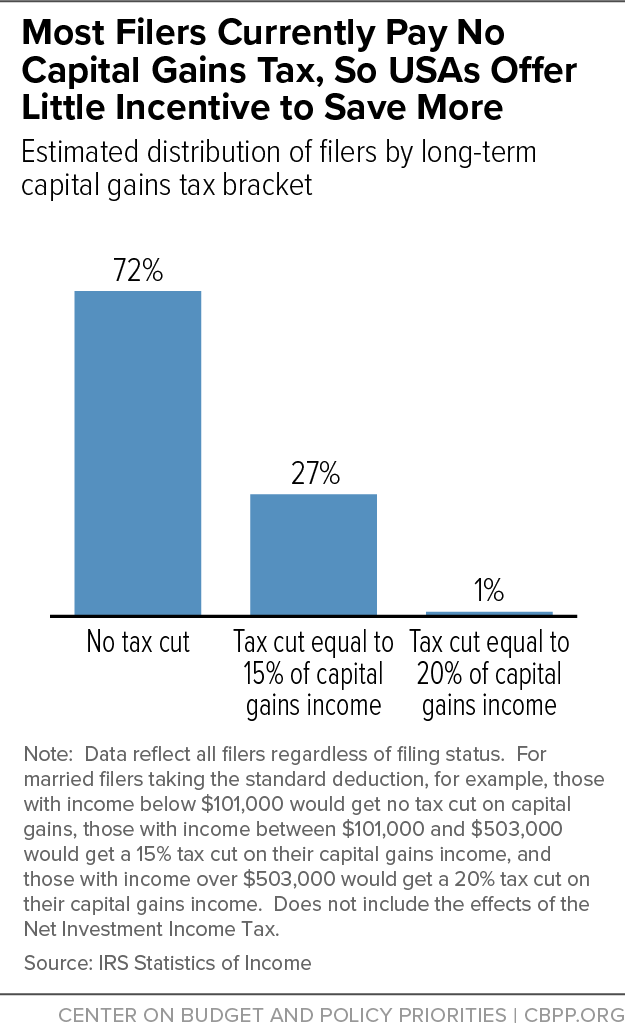

Most Filers Currently Pay No Capital Gains Tax So Usas Offer Little Incentive To Save More Center On Budget And Policy Priorities

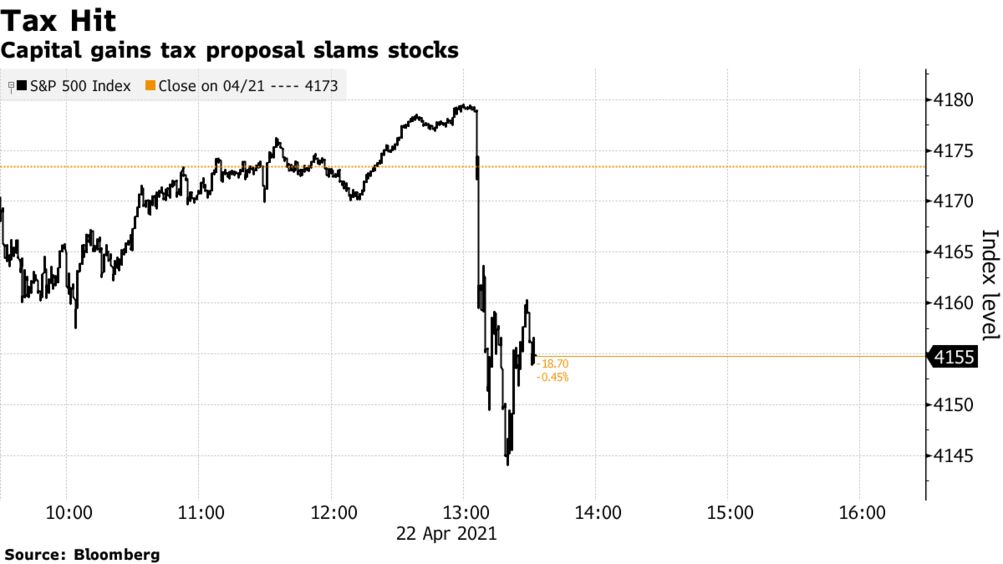

Wall Street On Tax Plan It Will Incentivize Selling This Year Bloomberg

Rethinking How We Score Capital Gains Tax Reform Bfi

The Details Of Hillary Clinton S Capital Gains Tax Proposal Tax Foundation

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

Senate Republicans Urge Biden Not To Move Forward On Capital Gains Tax Proposal Financial Regulation News

Biden Focuses On Capital Gains Taxes As He Seeks Money For Social Programs Wsj

Case Study 3 Reduced Tax Rates On Capital Gains And Qualified Dividends Tax Foundation

American Families Plan Potential Investor Impacts Russell Investments

House Capital Gains Tax Better For The Super Rich Than Biden Plan

Capital Gains Tax Reform How Proposals Would Affect You

What Is Up With President Biden S Tax Proposals Succession Planning

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

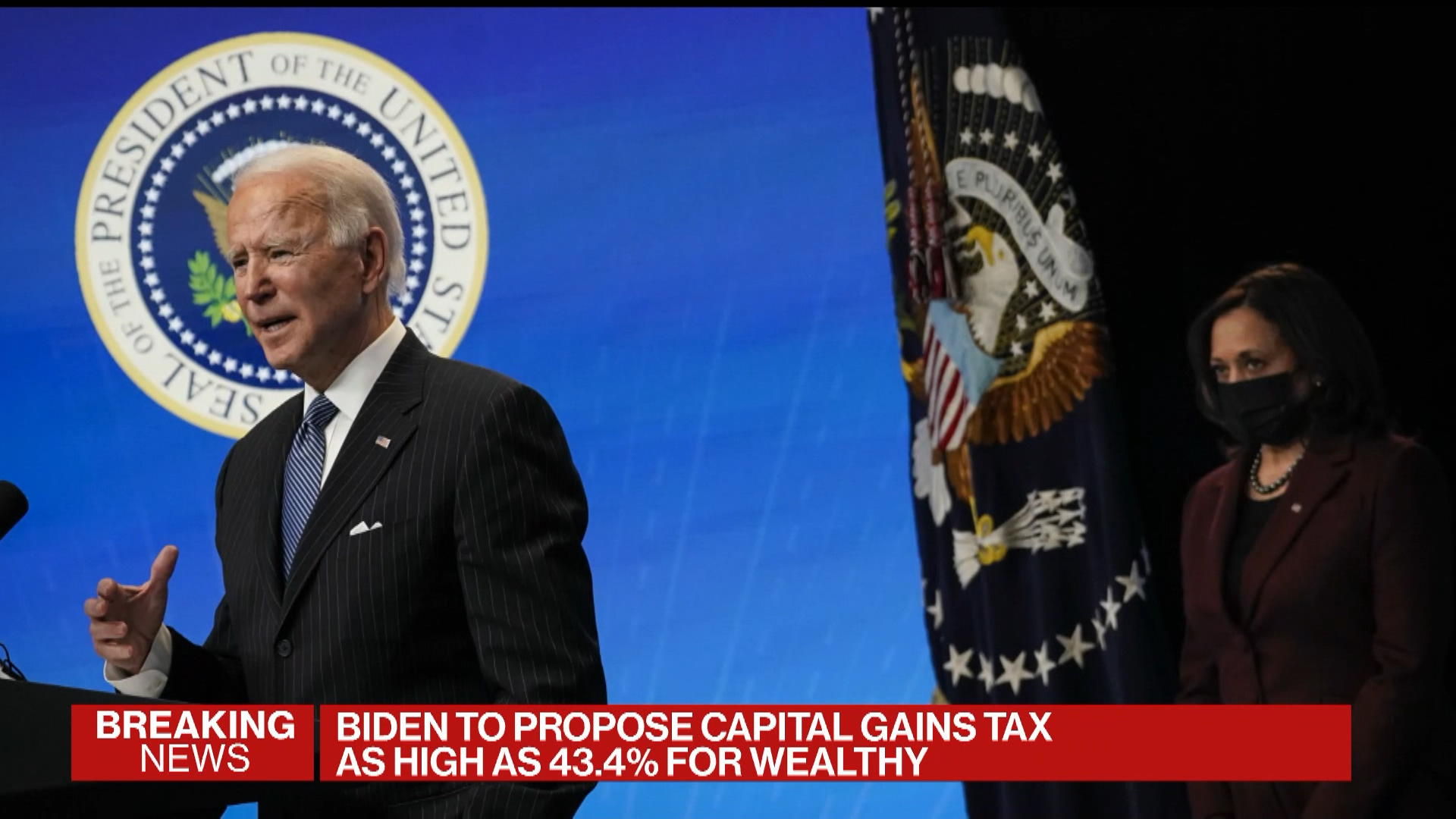

Biden Eyeing Tax Rate As High As 43 4 In Next Economic Package Bloomberg